Amazon  Main video

Main video

and  AppleTV+

AppleTV+

They may not be heads of streamers like Netflix, Max, and Disney+/Hulu just yet, but being owned and operated by tech giants with a track record of success in Silicon Valley certainly doesn't hurt their position on the rungs of the SVOD hierarchy.

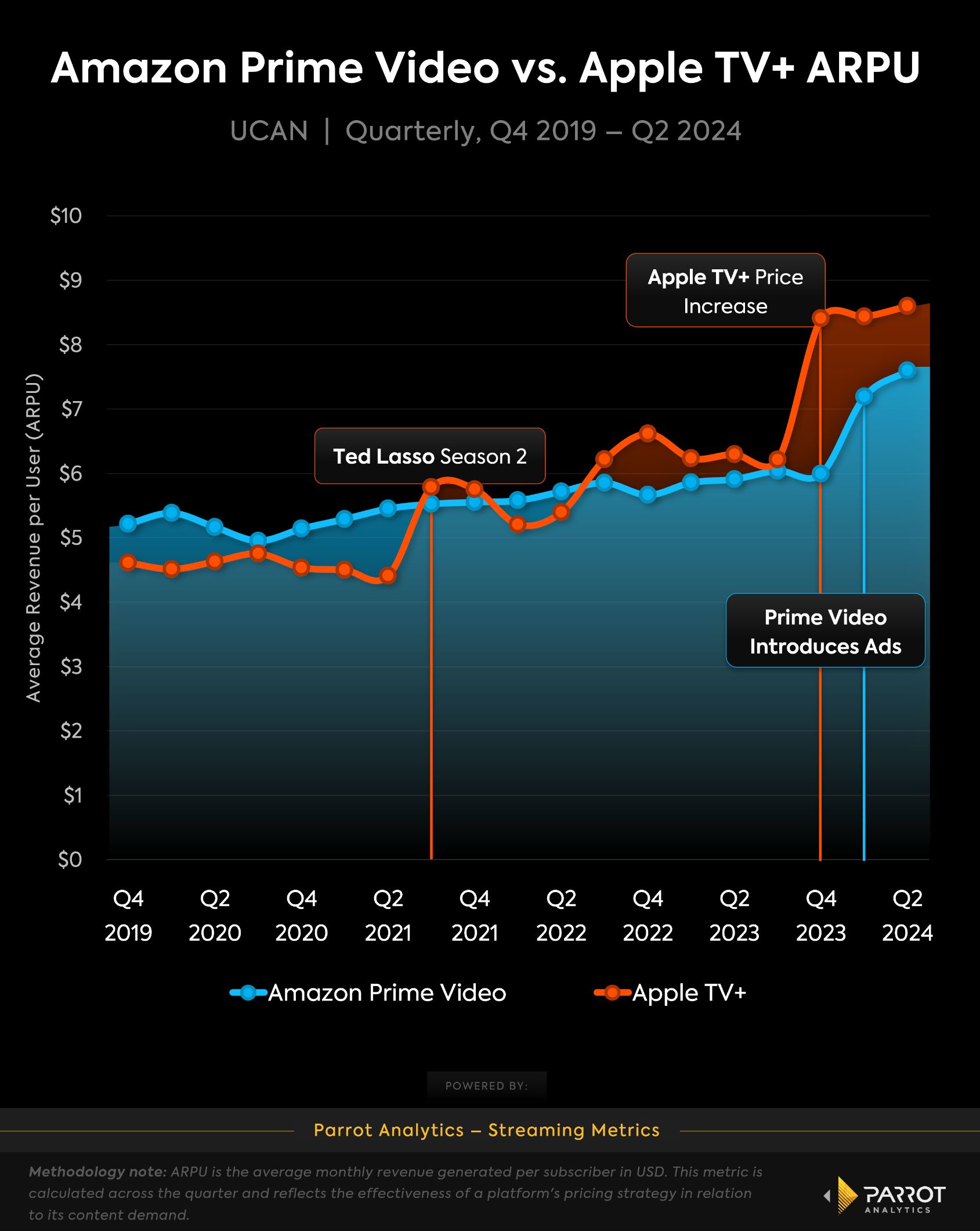

Both have followed similar business strategies with their streaming platforms in 2024 in an effort to increase revenue: Prime introduced an opt-out advertising tier in early 2024, and Apple TV+ raised prices by three dollars in late 2023. Although Amazon and Apple no longer disclose metrics from their streaming divisions, video when they report quarterly earnings, Parrot Analytics' streaming metrics show that these moves (literally) paid off.

Prime Video and Apple TV+'s streaming earnings, explained

The financial benefit was practically immediate

As the graph above shows, both streamers have seen significant gains in ARPU (average revenue per user) over the last year in the UCAN region (USA and Canada). Apple TV+ saw a 33% jump in quarterly revenue following its price increase from $6.99 to $9.99 in Q4 2023. Prime saw a 19.2% increase in revenue following the introduction of ads with the option to pay ad-free during the first quarter of 2024. These increases were significant and almost immediate once these changes were implemented.

Given your earnings, it is safe to assume that Main video and AppleTV+ They will probably learn from each other's achievements...

Additionally, Amazon reported during its Q3 2024 earnings call (via Variety) that its ad revenue soared, with ad sales increasing 19% year over year after arriving on Prime. And, according to JustWatch's own metrics (via Cult of Mac), Apple TV+'s price increase hasn't slowed growth, steadily increasing audience share this year and accounting for about 8% of total U.S. SVOD viewership in Q3. Other ratings boosters for Prime and Apple TV+ this summer were a successful (and highly anticipated) new season of The boys and a serialized adaptation of Presumed innocent starring Jake Gyllenhaal, respectively.

Prime Video and Apple TV+ price increases have not been without consequences

However, raising prices and introducing ads is notoriously unpleasant, and neither Apple TV+ nor Prime have resisted this trend. Platforms may now be better positioned to monetize their subscribers like their SVOD competitors with more traditional business models, but, according to Parrot Analytics, price increases and introducing ad tiers led to more overall churn (i.e. the number of people canceling their subscriptions increased).

In the short term, this may have reduced subscriber numbers, and it remains to be seen how these business practices will continue to affect platforms in the long term. But for now, given his earnings, it's safe to assume that Main video and AppleTV+ will likely learn from each other's achievements: people are willing to shell out a few more dollars for highly acclaimed original content or watch an ad or two to go with their favorite shows or movies.