NBCUniversal had a golden third quarter in 2024, and much of that was due to its comprehensive coverage of the Paris Olympics. Revenue from parent company Comcast’s media segment (which consists of NBCUniversal as well as streamer  Peacock

Peacock

) rose almost 37%. The Paris Olympics averaged about 30.3 million viewers daily across all NBCUniversal cable channels, which include Bravo, CNBC, E!, MSNBC, Oxygen, SYFY. Peacock scored so many wins during the Paris Games that Wall Street may now see it as a true competitor in streaming, rivaling the likes of Netflix.

But can NBCUniversal’s streamer really compete? There was an increase of 3 million subscribers in the third quarter of 2024 and its revenue grew 82% (year-over-year) to $1.5 billion, but a one-time sporting event like the Olympics may not be what retains subscribers in the long term. This will be driven by popular titles and valuable IP – which hasn’t been Peacock’s strong suit.

Peacock’s original content has struggled to leave a mark

Although, in many cases, it is worth achieving

While Comcast’s entertainment assets date back to the 1940s, Peacock’s original content portfolio is just five years old and relatively small. Quality productions were made for the NBCUniversal streamer, but lack of quantity and a confusing marketing strategy prevented Peacock from being discovered in the increasingly competitive streaming landscape.

The new comedy-thriller series Satanic Panic Hysteria!, for example, it’s been loved by critics so far, but it barely caught on online (nor was it widely released on Peacock). Other Peacock originals have had solid writing, casting, and cinematography, but have had the same fundamental promotional problems (include Based on a true story; Bel-Air; We are feminine pieces; The Tattoo Artist of Auschwitz; The Estancia; and Mrs.).

Perhaps the only Peacock original to capture mainstream attention was the Natasha Lyonne-led Mystery of the Week poker faceBut Season 2 isn’t rushing to save the platform from the stunning lack of large, loyal fan bases for its other originals.

Yellowstone is the Peacock subscriber juggernaut

And this can become a problem

What the streamer does have, however, is yellow stone, a Paramount production that has been Peacock’s saving grace. Taylor Sheridan’s flagship series kicked off the neo-Western television trend in 2018 and glued all of our parents to their screens. It’s no surprise to anyone who has paid attention to the rankings over the years, but yellow stone and its consequences, 1883 and 1923, consistently draws the attention of the cable TV crowd when episodes are broadcast (Forbes), and are a boon to the streamers who host the show (THR).

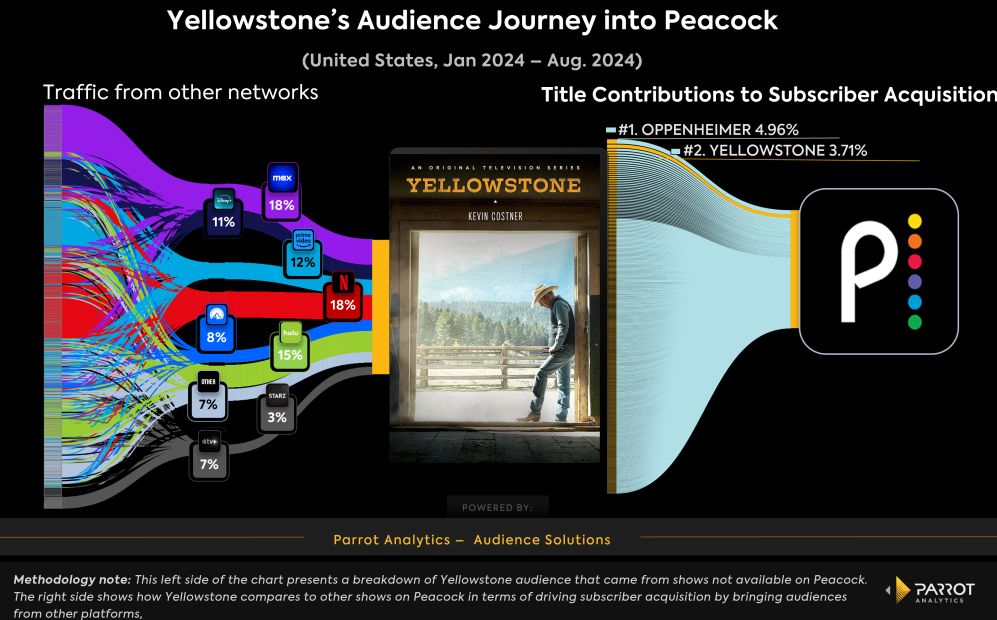

According to the latest data from Parrot Analytics, Paramount Network licensing yellow stone to Peacock may have been one of NBCUniversal’s smartest moves with its expanding streamer. Peacock launched nationally in the middle of the pandemic (July 15, 2020) and to increase adoption, yellow stone was advertised as an advantage. In 2024, the program was responsible for 3.71% of subscriber acquisition, second among all titles just for the Oscar-winning film Oppenheimer (4.96%).

Even more intriguing is how yellow stone is attracting subscribers from other streamers to Peacock. Parrot Analytics Audience Journeys Toolwhich tracks what drove audiences to a particular show, reveals the collapse of yellow stonePeacock viewers from January 2024 to August 2024 in the United States: About 18% tuned in after watching something on Max; 18% from Netflix; 15% from Hulu; and 8% from Paramount+ (which already has several Sheridan programs exclusive to its platform).

Peacock will need to find its own Yellowstone-level hit, preferably with franchise potential, to compete with other streamers…

However, yellow stone it will not exist forever. The show ends with Season 5, which premieres its second and final installment on Sunday, November 10 (and unlike previous seasons, it may be harder to attract viewers following Costner’s departure from the show). Additionally, while Peacock yellow stone The streaming rights reportedly last four years after the final episode airs, eventually leaving the service. There are already more yellow stone spinoffs in the works, but Paramount+, not Peacock, will be the streaming home of the franchise’s future.

Netflix Just Overtook Peacock in an Unprecedented Way

And your 2025 will likely be even stronger

At some point, Peacock will need to find its own Yellowstone-level success, preferably with franchise potential, to compete with other streamers, who already have many popular original shows and films. And if it wants to challenge Netflix, it needs to happen quickly, because the streaming titan continues to distance itself from the rest of the field.

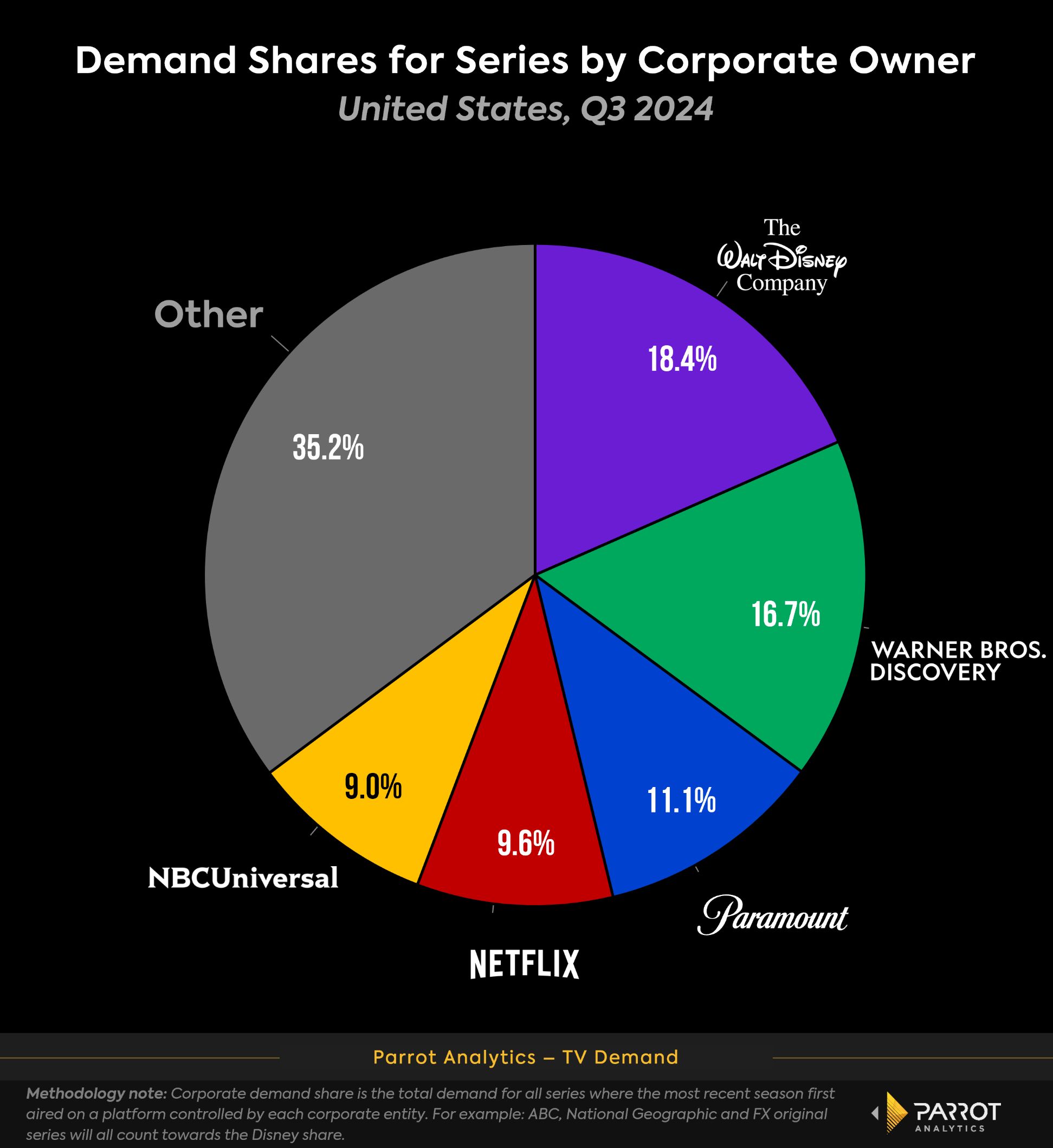

In the third quarter of 2024, Netflix exceeded Wall Street’s revenue expectations and jumped ahead of NBCUniversal in corporate demand share – that is, demand for all original television content produced under a company’s corporate umbrella. Netflix’s catalog, which dates back to 2012, was in greater demand than NBCUniversal’s, which dates back to the 1940s.

This is the first time Netflix has led a legacy studio on this metric. According to Parrot Analytics, the breakdown among all major streaming platforms in demand shares for series by corporate owner in Q3 2024 was: NBCUniversal (9%), Netflix (9.6%), Paramount (11.0%), 1%), Warner Bros. ) and The Walt Disney Company (18.4%).

Not only will Netflix end 2024 strong, but it will also enter 2025 swinging strong with experimental ventures and investing in its originals. Co-CEO Ted Sarandos said during the latest quarterly report that the company plans to focus more of its attention on gaming and live events, including a busy boxing match between YouTube influencer Jake Paul and sports veteran Mike Tyson, and that they are waiting for squid game 2nd season and the series finale Stranger Things season 5 will be a huge source of income for 2024 and 2025.

If Paramount Global’s ownership transition is rocky during its first year, Netflix could easily jump ahead other legacy studio in this key audience demand metric. Peacock may be coming off a strong year, but NBCUniversal needs to step up its original content production for the post-yellow stone future if you want to be considered a true competitor.